This article was first published in the Sunday Business Post, October 1st 2000

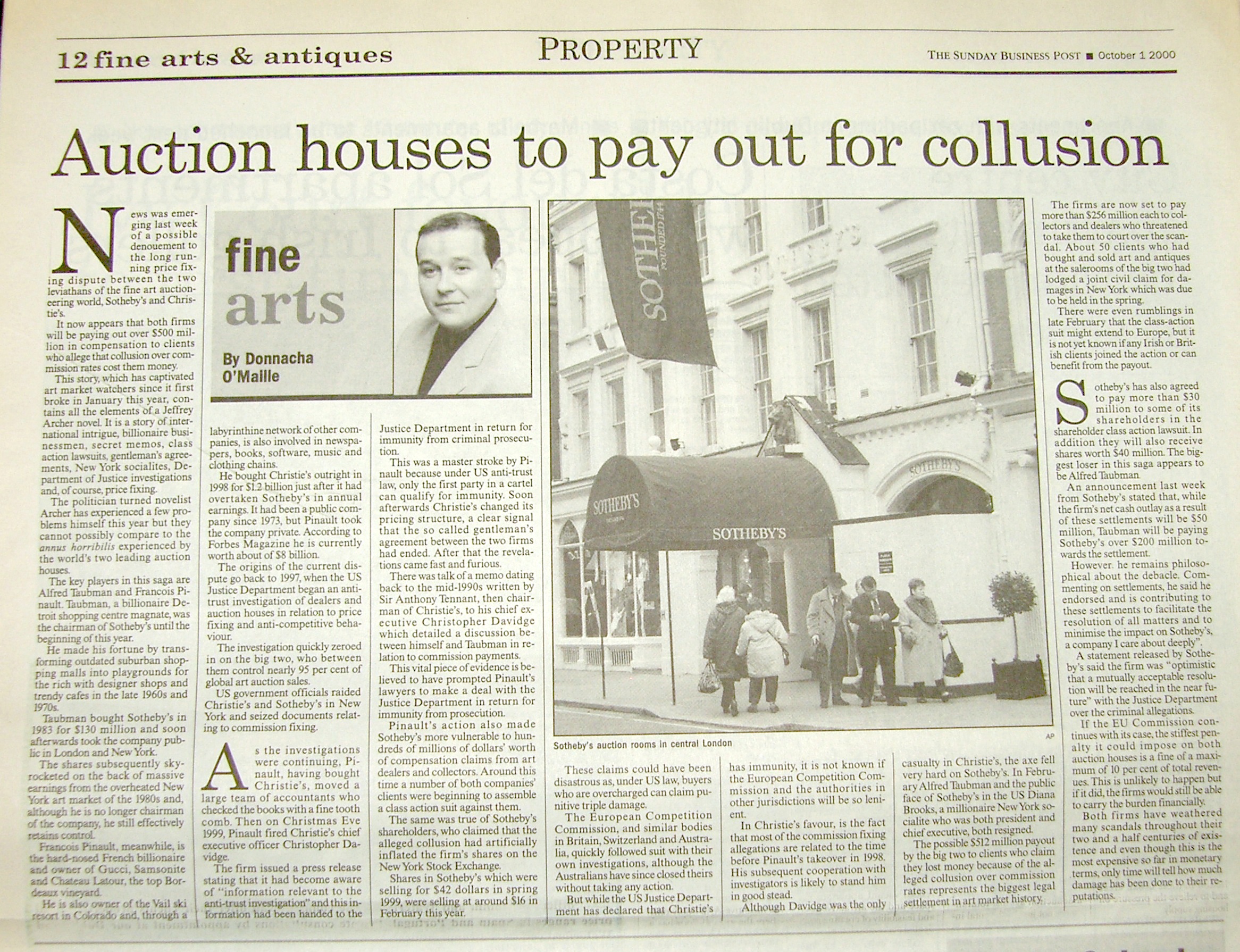

News was emerging last week of a possible denouement to the long running price fixing dispute between the two leviathans of the fine art auctioneering world, Sotheby’s and Christie’s

It now appears that both firms will be paying out over $500 million in compensation to clients who allege that collusion over commission rates cost them money.

This story, which has captivated art market watchers since it first broke in January this year, contains all the elements of a Jeffrey Archer novel. It is a story of international intrigue, billionaire businessmen, secret memos, class action lawsuits, gentleman’s agreements, New York socialites, Department of Justice investigations and of course, price fixing.

The politician turned novelist Archer has experienced a few problems himself this year but they cannot possibly compare to the annus horribilis experienced the world’s two leading auction houses.

The key players in the saga, are Alfred Taubman and Francois Pinault. Taubman, a billionaire Detroit shopping centre magnate was the chairman of Sotheby’s until the beginning of this year.

He made his fortune by transforming outdated suburban shopping malls into playgrounds for the rich with designer shops and trendy cafes in the late 1960’s and 1970’s.

Taubman bought Sotheby’s in1993 for $130 million and soon afterwords took the company public in London and New York.

The shares subsequently skyrocketed on the back of massive earnings from the overheated New York art market of the 1980’s and although he is no longer chairman of the company, he still effectively retains control.

Francois Pinault, meanwhile, is the hardnosed French billionaire and owner of Gucci, Samsonite and Chateau Latour, the top Bordeaux vineyard.

He is also owner of the Vail ski resort in Colorado and through a labyrinthine network of other companies, is also involved in newspapers, books, software, music and clothing chains.

He bought Christie’s outright in 1998 for $1.2 billion just after it had overtaken Sotheby’s in annual earnings. It had been a public company since 1973, but Pinault took the company private. According to Forbes Magazine he is currently worth about of $8 billion

The origins of the current dispute go back to 1997, when the US Justice Department began an antitrust investigation of dealers and auction houses in relation to price fixing and anticompetitive behaviour.

The investigation quickly zeroed in on the big two, who between them control nearly 95 per cent of global art auction sales.

US government officials raided Christie’s and Sotheby’s in New York and seized documents relating to commission fixing.

As the investigations were continuing, Pinault, having bought Christie’s, moved a large team of accountants who checked the books with a fine tooth comb. Then on Christmas Eve 1999, Pinault fired Christie’s chief executive officer Christopher Davidge

The firm issued a press release stating that it had become aware of “information relevant to the antitrust investigation and this information had been handed to the Justice Department in return for immunity from criminal prosecution.

This was a master stroke by Pinault because under US antitrust law, only the first party in a cartel can qualify for immunity. Soon afterwards Christie’s changed its pricing structure, a clear signal that the so called gentleman’s agreement between the two firms had ended. After that the revelations came fast and furious.

There was talk of a memo dating back to the mid1990s written by Sir Anthony Tennant, then chairman of Christie’s, to his chief executive Christopher Davidge which detailed a discussion between himself and Taubman in relation to commission payments

This vital piece of evidence is believed to have prompted Pinault’s lawyers to make a deal with the Justice Department in return for immunity from prosecution.

Pinault’s action also made Sotheby’s more vulnerable to hundreds of millions of dollars’ worth of compensation claims from art dealers and collectors. Around this time a number of both companies’ clients were beginning to assemble a class action suit against them.

The same was true of Sotheby’s shareholders, who claimed that the alleged collusion had artificially, inflated the firm’s shares on the New York Stock Exchange.

Shares in Sotheby’s which were selling for $42 in spring 1999, were selling at around $16 in February of this year.

These claims could have been disastrous as under US law, buyers who are overcharged can claim punitive triple damage.

The European Competition Commission. and similar bodies in Britain, Switzerland and Australia. quickly followed suit with their own investigations, although the Australians have since closed theirs without taking any action.

But while the US Justice Department has declared that Christle’s has immunity, it is not known if the European Competition Commission and the authorities in other jurisdictions will be so lenient.

In Christie’s favour is the fact that most of the commission fixing allegations are related to the time before Pinault’s takeover in 1998. His subsequent cooperation with investigators is also likely to stand him in good stead.

Although davidge was the only casualty in Christie’s, the axe fell very hard on Sotheby’s. In February Alfred Taubman and the public face of Sotheby’s in the US Diana Brooks, a millionaire New York socialite who was both president and chief executive, both resigned.

The possible $512niillion payout by the big two to clients who claim they lost money because of the alleged collusion over commission rates represents the biggest legal settlement in art market history.

The firms are now set to pay more than $256 million each to collectors and dealers who threatened to take them to court over the scandal. About 50 clients who had bought and sold art and antiques at the salerooms of the big two had lodged a joint civil claim for damages in New York which was due to be held in the spring. There were even rumblings in late February that the class-action suit might extend to Europe but it is not yet known if any Irish or British clients joined the action or can benefit from the payout.

Sothcby’s has also agreed to pay more than $30 million to some of its shareholders in the shareholder class action lawsuit. In addition they will also receive shares worth $40 million. The biggest loser in this saga appears to be Alfred Taubman.

An announcement last week from Sotheby’s stated that. while the firm’s net cash outlay as a result of these settlements will be $50 million, Taubman will be paying Sotheby’s over $200 million towards the settlement.

However, he remains philosophical about the debacle. Commenting on settlements he said he endorsed and is contributing to these settlements to facilitate the resolution of all matters and to minimise the impact on Sotheby’s, “a company I care about deeply”.

A statement released by Sotheby’s said the firm was “optimistic that a mutually acceptable resolution will be reached in the near future” with the Justice Department over the criminal allegations.

If the EU Commission continues with its case, the stiffest penalty it could impose on both auction houses is a fine of a maximum of 10 per cent of total revenues This is unlikely to happen but if it did the firms would still be able to carry the burden financially

Both firms have weathered many scandals throughout their two and a half centuries of existence and even though this is the most expensive so far in monetary terms, only time will tell how much damage has been done to their reputations.

This article was first published in the Sunday Business Post, October 1st 2000

Leave a Reply