Tag: Buying Art

-

Putting the hammer on the Big 2 good for collectors

This article was first published March 5th, 2000, in the Sunday Business Post The number of column inches that the price-fixing fiasco between Sotheby’s and Christie’s has received recently has been nothing short of startling. But the subsequent resignations, the US Justice Department antitrust investigations and the outcry from clients and shareholders have to a…

-

The beauty of buying time

This article was first published in the ‘Collector’s Corner’, Sunday Business Post, Feb 2000 under the title ‘Timely reminders’, and March 5th 2000, under the above title, ‘The beauty of buying time’ With the hullabaloo from the millennium celebrations and universal obsession with recording that moment now relegated to distant memory, it is worth looking…

-

Beauty can be profitable.

This article first appeared in the February 2000, in the Sunday Business Post Considering the current activity within the equity markets, especially with technological stocks on the Nasdaq, it is easy to forget that long before the performance of firms like Microsoft, Iona and Baltimore Technologies were part of dinner party conversations, the profit motive…

-

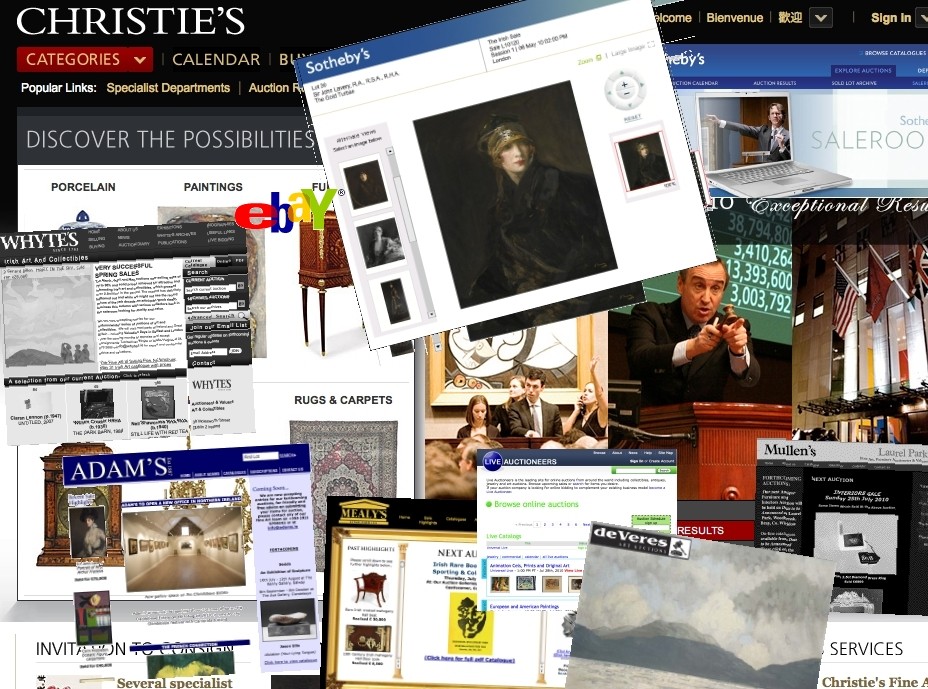

Auction Houses go online

This article was first published April 2, 2000 in the Sunday Business Post. Auction Houses go Online They said it couldn’t last. For months the analysts have been painting the walls with a dark thick impasto. The message was there for all to see – internet stocks were simply selling way above their value. As…