Tag: Investment

-

If you go down to the woods today.

This article was first published in Collectors Corner, Oct 1st, 2000 in the Sunday Business Post In case you hadn’t noticed from the masthead, today is the first of October. This is of no major consequence except for the fact that from now until the end of the year, we can expect to be…

-

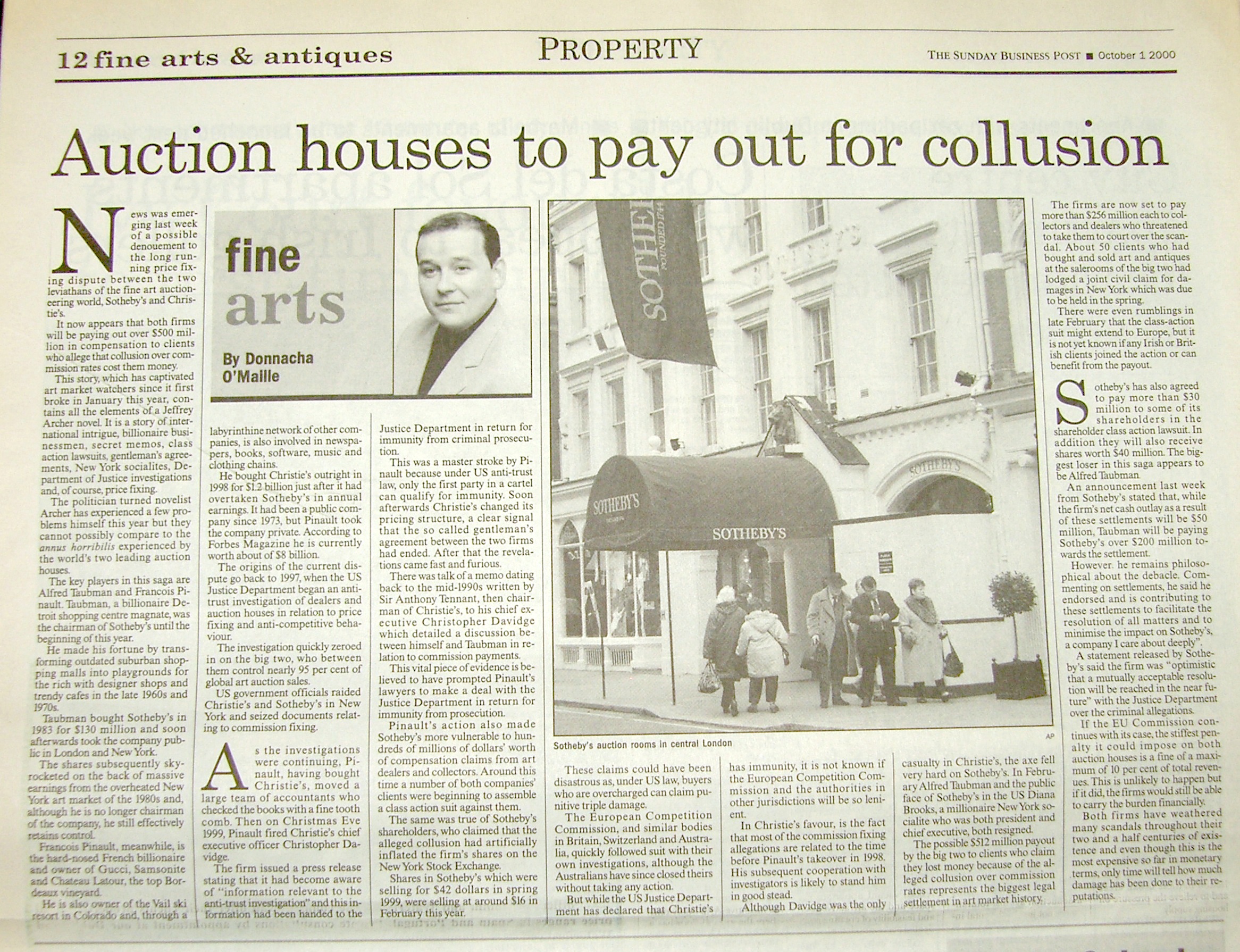

Auction houses to pay for collusion

This article was first published in the Sunday Business Post, October 1st 2000 News was emerging last week of a possible denouement to the long running price fixing dispute between the two leviathans of the fine art auctioneering world, Sotheby’s and Christie’s It now appears that both firms will be paying out over $500 million…

-

Books for pleasure and profit.

This article first appeared in the Collector’s Corner of the Sunday Business Post on 20 February 2000 Book collecting has for years inhabited an inaccessible world of dark, musty shops open only to the erudite and the initiated This esoteric image may have been true once. but today it is a myth. The business is…